Up to 40,000 euros can be claimed under certain conditions – sometimes, material costs can also be deducted. There are exceptions for owner-occupied property renovations. The family can deduct the remaining 1,150 from their expenses which leads to a tax relief of 230 euros (20%).

The high-quality carpet alone cost 2,000 euros, and as the government doesn’t want to financially support costs for a carpet (only the work completed by tradespeople), this part cannot be claimed on their taxes. The flooring expenses for their 70-square-meter apartment came to about 3,150 euros – this consists of material, labor costs, and tradespeople travel expenses. Since the landlord isn’t willing to pay for a new floor, the Eigendorf family hires a tradesperson to do the job and takes on the expenses themselves. Only 20% of tradespeople services can be claimed on your taxes, therefore the expenses must be pretty high (excluding material costs) in order to reach the maximum refund of 1,200 euros.Įxample: The Eigendorf family had a baby and moved into a larger apartment, but the old PVC flooring there is very worn and has several holes. As soon as there is a specific ruling, their tax assessment notice (Steuerbescheid) will be adjusted accordingly. The Federal Tax Court (Bundesfinanzhof) allows those affected by this rule to make an appeal referring to ongoing proceedings about these issues at the court. Typically, services completed in a workshop cannot be claimed on your taxes. The services must be for renovation, maintenance, or modernization measures – services such as meals on wheels or costs for grave maintenance could therefore not be claimed.

Tradespeople services must take place at your homeĪccording to § 35a of the Income Tax Act (EStG), tradespeople services must take place in the taxpayer’s home in order to be claimed on their tax return. Many contractors prefer to be paid in cash to avoid card payment fees, so ensure that you discuss types of payment with the company beforehand. It needs to be paid by other means: for example, by bank transfer, giro card, or credit card. In an attempt to prevent undeclared work, the invoice cannot be paid in cash. Invoice amount broken down into wage, travel, and material costs.The time period in which the work took place.The tradesperson’s name, address, and tax number (Steuernummer).

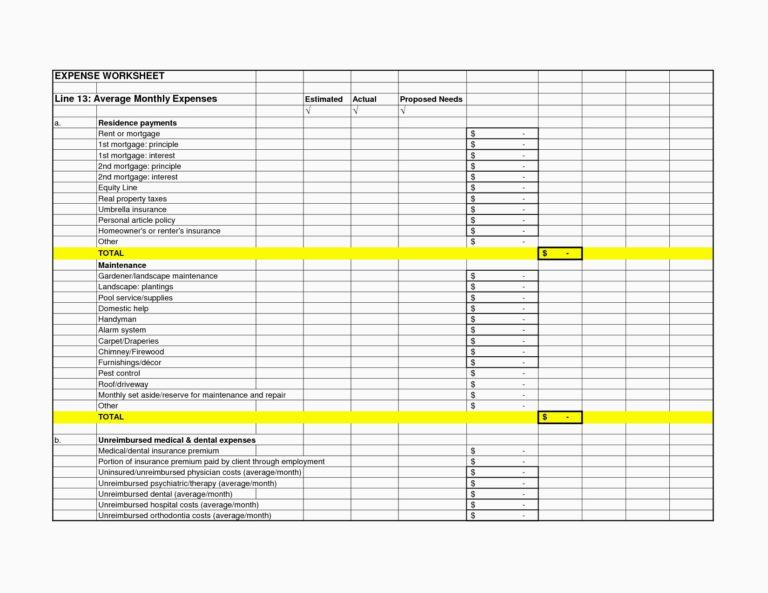

Your well-kept invoice should include the following information: If you don’t want to run into trouble with the tax office (Finanzamt) down the line, you should ensure that the invoices break down the costs of materials separate from the other expenses. What is required to claim these on my tax return? Invoices for tradespeople servicesĬompleted work and travel costs are the only tradespeople expenses that are relevant for tax purposes – material costs are not included. Save money: Tips for tradespeople expenses.Īlmost every taxpayer needs tradespeople (Handwerker) now and again: walls must be painted, new floors must be laid, and machines must be repaired – tradespeople’s’ activities are not just diverse, but also expensive – so it’s a good thing that invoices for the services can be claimed on your tax return (Steuererklärung)! Employees can potentially save up to 1,200 euros by provided proof of their tradespeople invoices.

TAX ACT CONTRACTOR EXPENSES HOW TO

Tax Reduction for Tradespeople Expenses: How to

0 kommentar(er)

0 kommentar(er)